massachusetts meal tax calculator

Clothing purchases including shoes jackets and even costumes are exempt up to 175. This is true whether you are based in Massachusetts or whether you are based in another state and have sales tax nexus in Massachusetts.

Pin On Best Of Mamafurfur Blog

2022 Massachusetts state sales tax.

. So you would simply charge the state sales tax rate of 625 to buyers in Massachusetts. For example while a ready-to-eat sandwich sold at a deli would be taxable a pound of turkey would be tax exempt. The tax is 625 of the sales price of the meal.

The most populous county in Massachusetts is Middlesex County. Massachusetts Income Tax Calculator 2021. Effective tax rate.

Details of the personal income tax rates used in the 2022 Massachusetts State Calculator are published. Massachusetts local sales tax on meals. Have a question about per diem and your taxes.

The base state sales tax rate in Massachusetts is 625. As provided in the Meal and Rest Break Policy requirements vary by state. You can use our Massachusetts Sales Tax Calculator to look up sales tax rates in Massachusetts by address zip code.

A product that costs more than 175 is taxable above that amount so a 200 pair of shoes would be taxed at 625 on the 25 above the exemption limit. Well speaking of Massachusetts there is a general sales tax of 625 on most of the goods which was raised from 5 in 2009. There is no sales tax on clothing of 175 or less than that.

Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant. As far as the prepared meals that are bought in the restaurant are concerned it is subject to a meal tax which is 625 other options applicable as well. While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

Figure out your filing status. The average cumulative sales tax rate in the state of Massachusetts is 625. To use our Massachusetts Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Six or more baked goods sold in a unit such as a pack of 6 bagels or a dozen donuts would also be tax exempt. Also check the sales tax rates in different states of the US. And all states differ in their enforcement of sales tax.

Massachusetts is a flat tax state that charges a tax rate of 500. Massachusetts Department of Revenue. After a few seconds you will be provided with a full breakdown of the tax you are paying.

Calculating your Massachusetts state income tax is similar to the steps we listed on our Federal paycheck calculator. Federal labor law requires overtime hours be paid at 15 times the normal hourly rate. This calculator is detailed and is designed for advocates or others familiar with Excel and the SNAP rules.

No Massachusetts cities charge their own local income tax. 625 of the sales price of the meal. This takes into account the rates on the state level county level city level and special level.

In Texas prescription medicine and food seeds are exempt from taxation. Please contact the Internal Revenue Service at 800-829-1040 or visit wwwirsgov. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store.

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. More than 40 percent of all Massachusetts cities and towns now assess the 075 local tax on meals. Free calculator to find the sales tax amountrate before tax price and after-tax price.

Most food sold in grocery stores is exempt from sales tax entirely. This page describes the taxability of food and meals in Massachusetts including catering and grocery food. So the tax year 2021 will start from July 01 2020 to June 30 2021.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Massachusetts local counties cities and special taxation districts. Local tax rates in Massachusetts range from 625 making the sales tax range in Massachusetts 625. The Massachusetts Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Massachusetts State Income Tax Rates and Thresholds in 2022.

Massachusetts sales tax rates vary depending on which county and city youre in which can make finding the right sales tax. Massachusetts doesnt have local sales tax rates only a statewide tax rate of 625. The state of Massachusetts provides more detail on Sales Tax on Meals.

Groceries and prescription drugs are exempt from the Massachusetts sales tax. Anyone who sells meals that are subject to sales tax in Massachusetts is a meals tax vendor If a liquor license holder operates a restaurant where meals are served. Vermont has a 6 general sales tax but an additional 10.

The minimum wage applies to most employees in Massachusetts with limited exceptions including tipped employees some student workers and other exempt occupations. If you save 30 of your earnings youll cover your small business and income taxes each quarter. Marginal tax rate 24.

15-20 depending on the distance total price etc. Massachusetts law makes a few exceptions here. Massachusetts Income Tax Calculator 2021.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Generally food products people commonly think of as groceries are exempt from the sales tax except if they are sold as a meal from a restaurant. That goes for both earned income wages salary commissions and unearned income interest and dividends.

If you make 70000 a year living in the region of Massachusetts USA you will be taxed 11667. To learn more see a full list of taxable and tax-exempt items in Massachusetts. The Massachusetts state sales tax rate is 625 and the average MA sales tax after local surtaxes is 625.

No matter what kind of. Work out your adjusted gross income Total annual income Adjustments Adjusted gross income calculate your taxable income. If you arent sure how much to withhold use our paycheck calculator to find your tax liability.

The meals tax rate is 625. Exact tax amount may vary for different items. Counties and cities are not allowed to collect local sales taxes.

Find your Massachusetts combined state and local tax rate. The IRS says on its website that under Section 179 of the tax code the TCJA increased the maximum Section 179. Massachusetts has a 625 statewide sales tax rate and does not allow local.

Food clothing items under 175 admissions sales and most utilities and heating fuel are exempt from the Massachusetts sales tax.

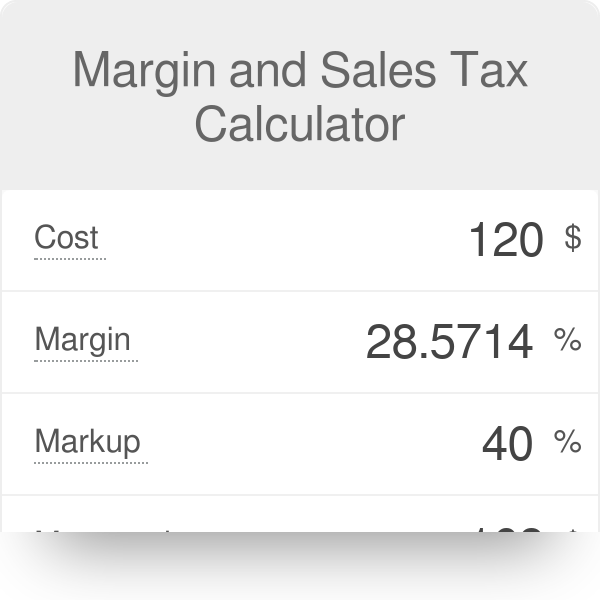

Margin And Sales Tax Calculator

Key Tax Planning Tips For These Volatile Times Tax Reduction Business Tax Tax Deductions

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

Massachusetts Income Tax Calculator Smartasset

The Consumer S Guide To Sales Tax Taxjar Developers

Income Tax Calculator Estimate Your Refund In Seconds For Free

Why You Need To Understand Your Finances Video Video Budgeting Unexpected Expenses Macros

Use This Sales Tax Calculator To Figure Sales Tax Or Vat Gst At A Rate Of 15 Free To Download And Print Sales Tax Calculator Tax

Connecticut Sales Tax Calculator Reverse Sales Dremployee

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

How To Calculate Income Tax In Excel

How To Calculate Cannabis Taxes At Your Dispensary

2 000 After Tax Us Breakdown June 2022 Incomeaftertax Com

Kelly Cpa On Instagram Things Not Adding Up Chances Are If You Are Still Using This To Handle Your Monthly Bookkeeping You Bookkeeping Cpa Office Phone

Bmichart Albert Panosundaki Pin

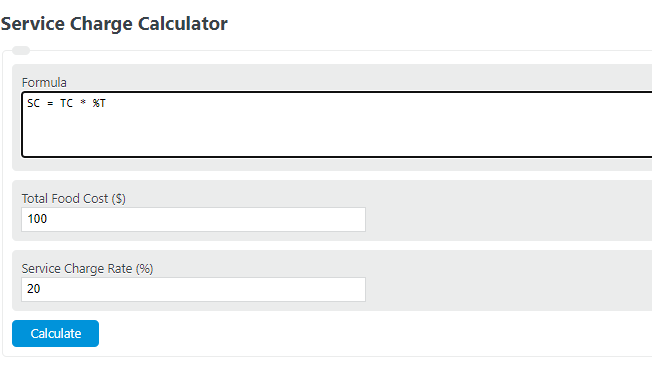

Service Charge Calculator Calculator Academy

6 75 Sales Tax Calculator Template Tax Printables Sales Tax Tax